Omai Gold Mines Corp. is advancing its 100%-owned Omai Gold Project in Guyana, a past-producing operation. Over the past four years, the Omai team has delivered significant new discoveries. The project benefits from established infrastructure, a proven mining jurisdiction, and recent exploration success that has grown resources well beyond historical production of 3.8 million ounces of gold produced between 1993 and 2005.

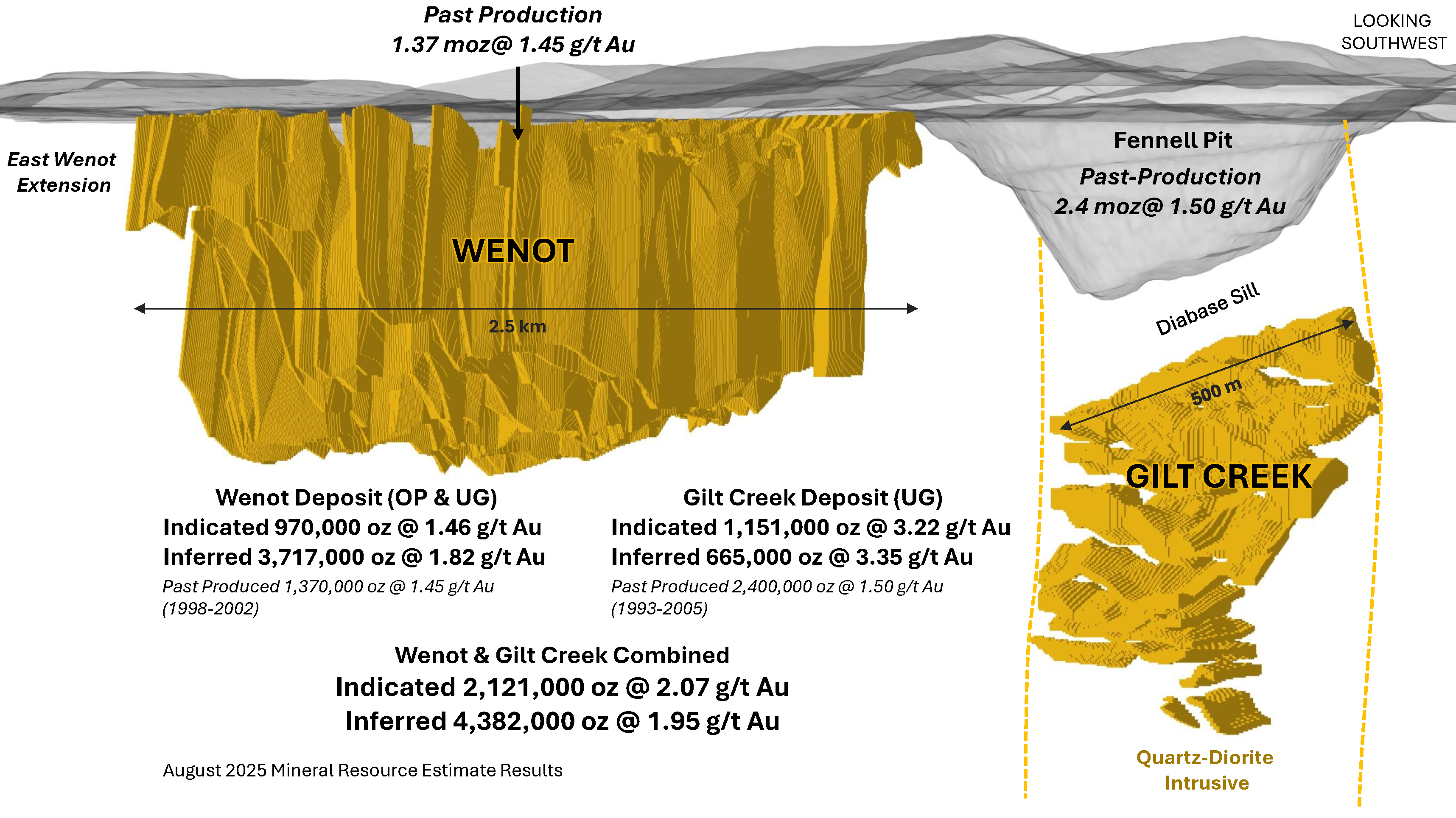

In August 2025, the Company announced an updated NI 43-101 Mineral Resource Estimate of 4.4 million ounces of gold (Inferred) averaging 1.95 g/t Au in 69.6m tonnes and 2.1 million ounces of gold (Indicated) averaging 2.07 g/t Au in 69.6 Mtonnes hosted within the adjacent Wenot and Gilt Creek deposits. Drilling has continued with 5 drill rigs. A further updated Mineral Resource Estimate is planned to be followed by an updated Preliminary Economic Assessment (“PEA”), planned for completion H1 2026. This includes a much larger mine plan with the expanded Wenot Mineral Resource Estimate and will also incorporate the Gilt Creek underground deposit into the mine plan for the first time.

Updated Mineral Resources (August 25, 2025)

Omai hosts two adjacent gold deposits: Wenot (shear-hosted, open pit) and Gilt Creek (intrusion-hosted, underground).

Mineral Resource Estimate (NI 43-101, effective August 25, 2025):

- Wenot (constrained pit, 0.35 g/t Au cut-off):

- 970,000 oz Indicated @ 1.46 g/t Au in 20.7M tonnes

- 3,720,000 oz Inferred @ 1.82 g/t Au in 63.4M tonnes

- Gilt Creek (underground, 1.5 g/t Au cut-off):

- 1,150,000 oz Indicated @ 3.22 g/t Au in 11.1M tonnes

- 660,000 oz Inferred @ 3.34 g/t Au in 6.2M tonnes

This represents a 16% increase in Wenot Indicated ounces and a 130% increase in Wenot Inferred ounces compared to the October 2022 estimate.

The Mineral Resource Estimate1 was prepared in accordance with the CIM Definition Standards (2014) and Estimation Best Practice Guidelines (2019), under the supervision of an Independent Qualified Person as defined by NI 43-101.

1 NI 32-101 Technical Report dated October 9, 2025 titled "Updated Mineral Resource Estimate and Technicall Report on the Omai Gold Property, Potaro Mining District No. 2, Guyana" was prepared by P&E Mining Consultants Inc. and is available on www.sedarplus.ca and on the Company's website.

Preliminary Economic Assessment (April 2024)

A baseline Preliminary Economic Assessment (“PEA”) was announced on April 4, 2024, evaluating an initial open-pit development scenario for the Wenot deposit only. The PEA incorporated approximately 45% of the project’s total resources.

Base Case ($1,950/oz Au):

- After-tax NPV5%: US$556M

- After-tax IRR: 19.8%

- Average annual gold production: 142,000 oz over 13 years (peak: 184,000 oz)

- Total production: 1.84 Moz

- Initial CAPEX: US$375M

- AISC: US$1,009/oz

Sensitivity ($2,200/oz Au):

- After-tax NPV5%: US$777M

- After-tax IRR: 24.7%

- Payback period: 3.5 years

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable classification as Mineral Reserves. There is no certainty that the PEA results will be realized.

An updated PEA is planned for completion in late Q4 2025 or early Q1 2026" to completion in H1 2026.

Historic Production

The former Omai mine produced 3.8 Moz of gold (1993–2005) at an average grade of 1.5 g/t Au. During that period, gold prices averaged less than US$400/oz, yet the operation profitably produced more than 300,000 oz per year.

Exploration and Growth

Exploration drilling continues to:

- Test extensions of the Wenot deposit along strike and at depth.

- Evaluate high-grade near-surface zones for potential early mill feed.

- Investigate regional targets identified through geophysics and structural modelling.

Management believes there is potential to expand existing resources and to discover additional deposits across the Omai property. Exploration targets are conceptual in nature, and there has been insufficient exploration to define them as Mineral Resources. It is uncertain if further exploration will result in the targets being delineated as Mineral Resources.

Land Tenure & Infrastructure

- 100% interest in three licenses granted by the Guyana Geology & Mines Commission (no joint ventures or third-party payments; annual holding costs <US$20,000).

- Access by road, barge, and a 1 km airstrip.

- Planned Amaila Falls hydropower project and transmission corridor could provide future power options.